Interview with Charlotte Peuron, fund manager at Crédit Mutuel Asset Management.

How did this asset class perform during this banking crisis?

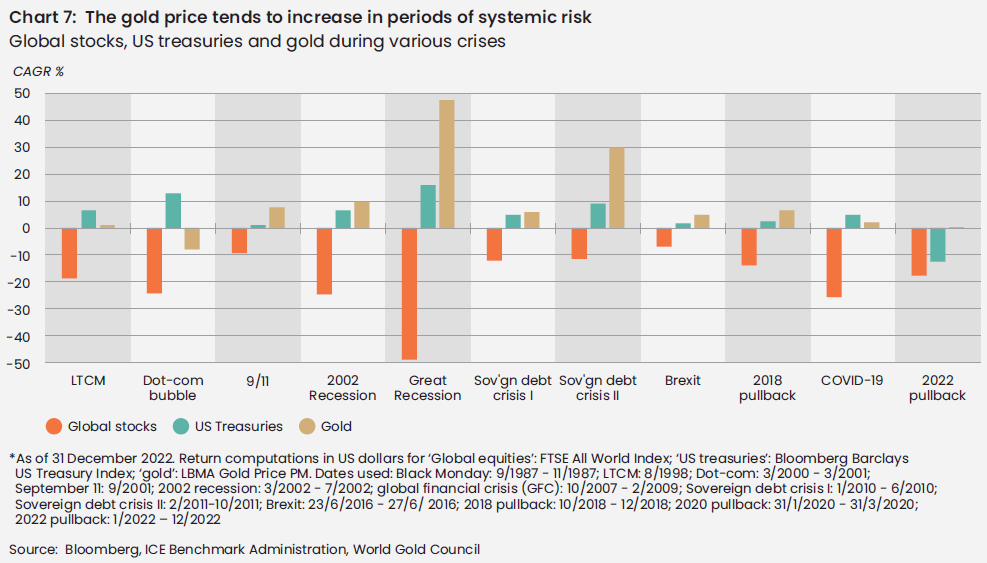

In the first quarter of 2023, gold and the precious metals sector helped to diversify portfolios (see World Gold Council chart below). In March 2023, gold climbed nearly 8% and gold companies 18.3% (Nyse Arca in USD). After a start to the year of profit taking, the banking crisis in the United States, which eventually quickly exported to Europe through Credit Suisse, pushed gold to its highest levels. The dollar's fall as a result of slower monetary tightening in the United States and further tightening in other regions is keeping gold high. This is illustrated by the recent correlation between the price of gold and the evolution of the ‘Atlantic spread.’

Demand remains strong from jewelry and technology (respectively 40% and 10% of demand today) and central banks are still net buyers of gold. Investment demand is more uncertain today. However, given recent financial events, we remain optimistic for the trend ahead.

What about your recent meetings with companies producing precious metals?

This positive price trend is very positive for precious metals producers. With an average gold price of per ounce in Q1-2023 and production costs averaging around 遂/oz (for 2023), corporate margins will be very high. This raises valuations and explains companies' outperformance versus metal prices at the end of the quarter. This should also continue, especially for gold, which stands above per ounce.

Following our recent exchanges, we are confident in companies' ability to deliver good operational performances. Cost pressures are easing, although wage costs are still stretched in some countries such as Canada and the United States. Exploration drilling costs are also under pressure. This is due to the current strong demand, particularly in the exploration of other metals such as lithium... This could lead to some budget increases and increase exploration times.

The rise in energy costs has accelerated investments in alternative energies where possible, so many companies have developed solar farms for the supply of part of electricity.

We are also seeing a growing interest among gold producers in diversifying into, for example, copper.

What is the performance of CM AM Global Gold?

Since the beginning of 2023, CMAM Global Gold has returned +9.8% * (as at 31 March 2023), benefiting fully from the sector's upward momentum. We were underweight in January and February and reweighted in March to 98%. Following several meetings with management, we invested in Victoria Gold. After facing some difficulties in 2022, the company is in the recovery phase. M & A remains an important driver, so Victoria Gold could be a target in the concentration move. In return, we trimmed our position in I-80 Mining, which is slowing down. As all assets are in Nevada, development costs could be raised. In the majors we still prefer Barrick Gold versus Newmont which is in ‘discussion 'with Newcrest. Following the completion of the deal on Yamana Gold, we are also well weighted on Agnico Eagle Mines.