Interview with Charlotte Peuron, Fund Manager, CM-AM Global Gold

In today's uncertain period when the inflationary environment appears to be taking hold, how does the strategic interest in gold and commodity related investments change?

In periods of inflation or stagflation (low growth + inflation), investors are turning to assets that will benefit from these trends. Gold and commodities are part of these assets. Gold also benefits from its safe haven quality Gold companies are partially correlated to the price of gold.

When rates rise, can gold and commodities offer better value than fixed income?

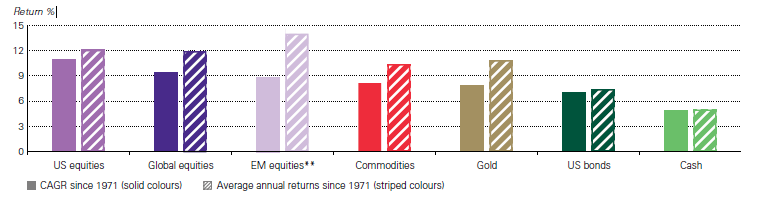

p>The rise in real rates penalizes yield free assets such as gold or raw materials because the cost of holding increases. However, in a period of inflation or stagflation real interest rates remain low, as they are at present. According to a study by the World Gold Council, the performance of gold is higher than the yield of bonds.

So gold has a place in an allocation.

What are the advantages of gold companies?

The advantages of gold companies versus gold are as follows: Operating and financial leverage; creation of value, particularly through projects and the growth of reserves; dividends to ensure the proper execution of mining plans and the proper allocation of capital.

The price of gold equities is highly correlated to the development of gold prices in the short term, but it amplifies movements of the underlying stock, as a rule, on a relation of two to three, both on the upside and on the downside. These different levels of volatility explain the performance spreads in the medium and long term.

Do they present risks in the face of a gold correction?

YES, gold companies are called ‘price taker’ their revenues and results depend certainly on their production and their costs that they control but also on the price of the underlying (gold, silver, copper...) that they do not control at all. In addition, when the underlying price falls, all other things equal their income, their margins as well as the value of their reserves fall. Securities therefore sold off significantly. As gold prices rise, the performance of gold companies benefits from leverage.

What is your positioning on commodities in the face of the war in Ukraine?

Our exposure rate remained very high in the first weeks of the month in order to take advantage of the quality of gold as a safe haven for investors at a time of increasing political and economic risks. The acceleration and sustainability of inflation that followed forced central banks, particularly the US Federal Reserve, to act vigorously to counter the inflation that the western world has not seen for decades. The acceleration of the rise in US long rates, leading to a rise in real rates above ‘0,’ accompanied by the rise in the US dollar, penalized gold and the gold sector. During this period, our exposure rate was from 5% to 7% and we increased the weighting of royalty companies less affected by the fall in metal prices and inflationary pressures on production costs.

What are the main features of CM AM Global Gold? What are their performance targets?

CM-AM Global Gold is an international equity fund invested in precious metal companies. The fund is not intended to have exposure to metals, whether directly (physical gold) or indirectly through financial instruments (ETC, Future, etc.). The objective of the CM AM Global Gold fund is to outperform the performance of gold mining and commodity related stocks through selective management of gold and natural resources related stocks, free of any geographical allocation. For indicative purposes the fund's performance may be compared to the performance of FTGoldMines valued in euros.

What is the structure of your portfolio? What are your main positions?

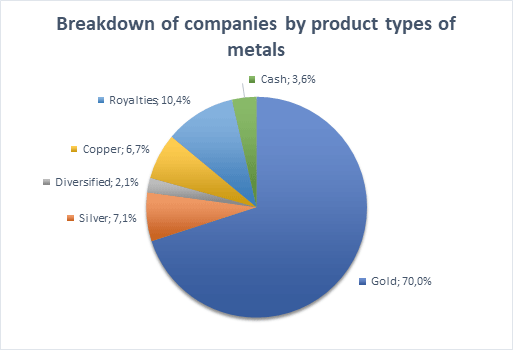

As of 25 August 2022, the structure of the portfolio is as follows:

To date, CMAM Global Gold has 43 holdings, of which are the top 10.

Exposure to the main currencies was as follows:

| EUR/USD | 15.13% |

|---|---|

| EUR/CAD | 68.36% |

We have no currency hedging policy.

What is your outlook for gold in the second half of 2022?

Given the economic, financial and political environment, we believe gold prices are likely to remain strong, remain a safe haven in times of uncertainty, and there is still plenty of that at the moment. However, at Jackson Hole, central bankers strongly reiterated their commitment to fight inflation, certainly by sacrificing economic growth. This will increase gold price volatility. For companies, the half-year results showed an increase in operating costs as expected and discussed by companies during the half year. This is also the case for costs for future developments, so the marginal cost of extraction will increase. As for all companies, these inflationary pressures will persist for a few quarters (energy and materials prices, labor prices or difficulties in hiring, logistics, etc.). These inflationary pressures do not affect all companies in the same way, so in the coming months, stock picking, the quality of companies and their cost structures will make a difference.